The transformation of the us betting industry over the last decade is nothing short of a digital revolution. What was once a fragmented landscape of localized horse racing tracks and the neon-lit corridors of Las Vegas has exploded into a multi-billion dollar national powerhouse. As we navigate through 2025 and look toward 2026, the sector is defined by rapid legislative expansion, sophisticated mobile technology, and a shift in cultural acceptance.

Today, more than half of all American adults participate in some form of regulated wagering. This growth isn’t just about sports; it’s about a fundamental shift in how Americans consume entertainment. In this deep dive, we explore the legal frameworks, market leaders, and the future trends that are currently shaping the world of us betting.

Table of Contents

The Legal Landscape: From PASPA to a Patchwork Nation

The modern era of us betting truly began in May 2018. The Supreme Court’s decision to strike down the Professional and Amateur Sports Protection Act (PASPA) effectively ended the federal ban on sports wagering, handing the power back to individual states.

The Current Map (As of late 2025)

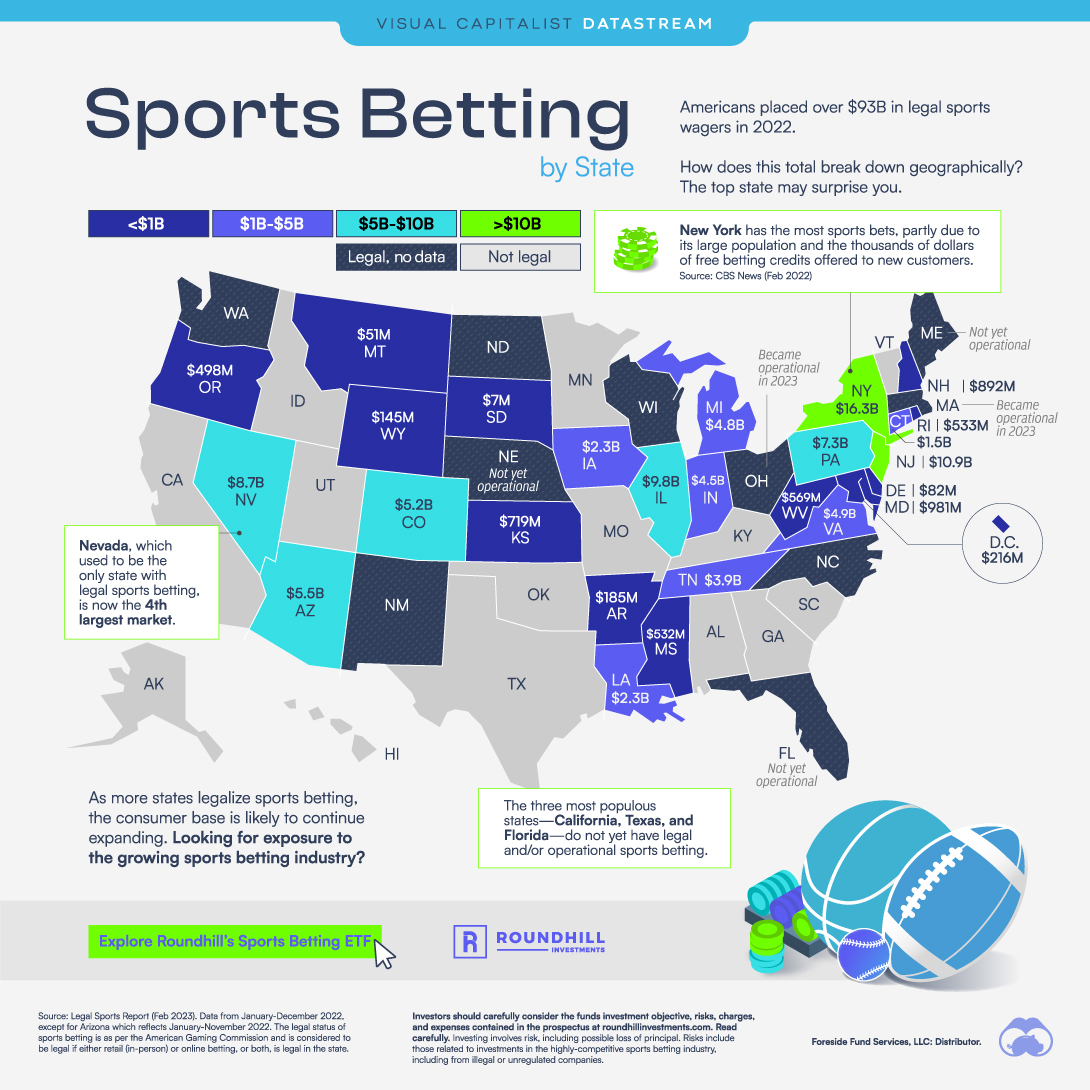

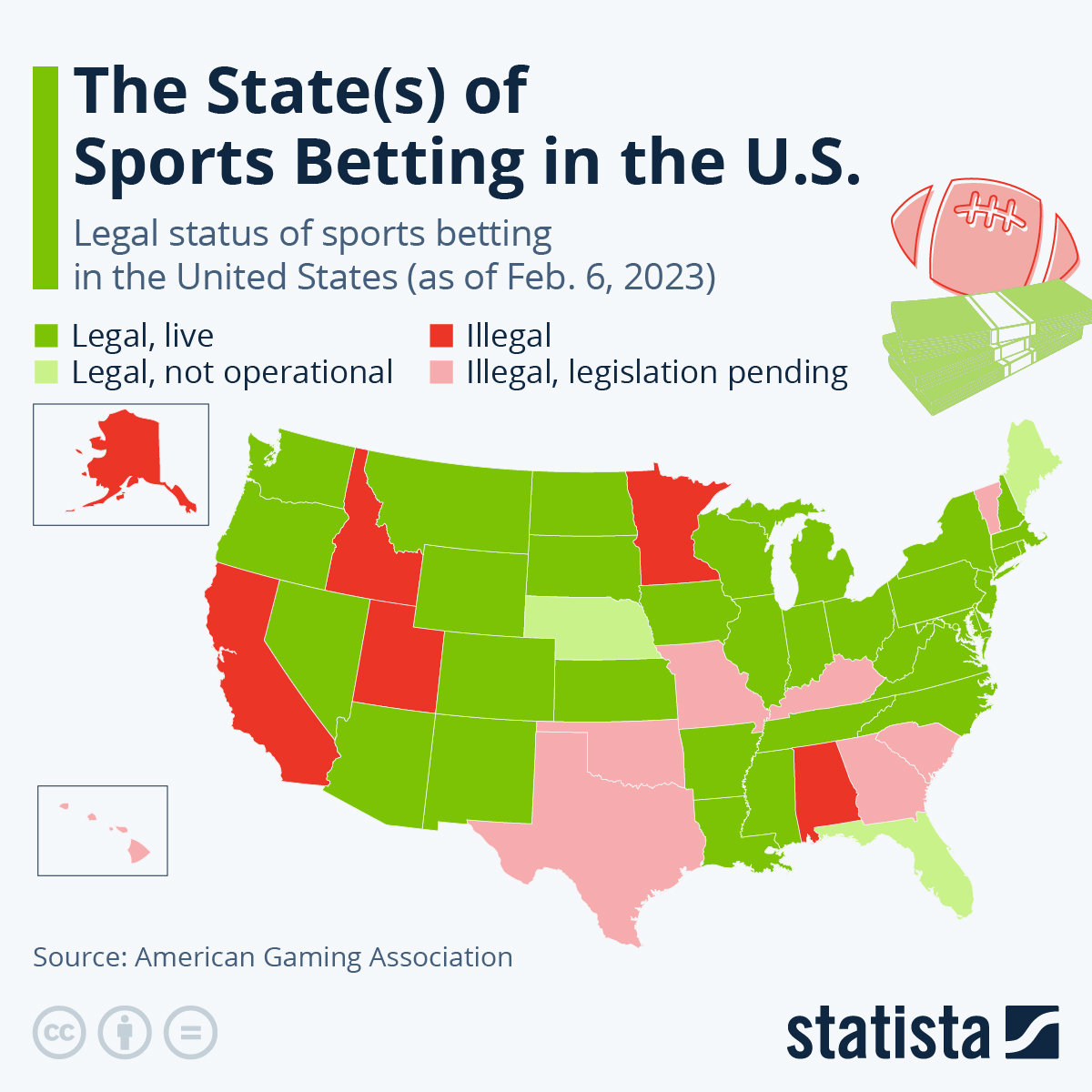

As we close out 2025, the map of the United States looks drastically different than it did just five years ago. Currently:

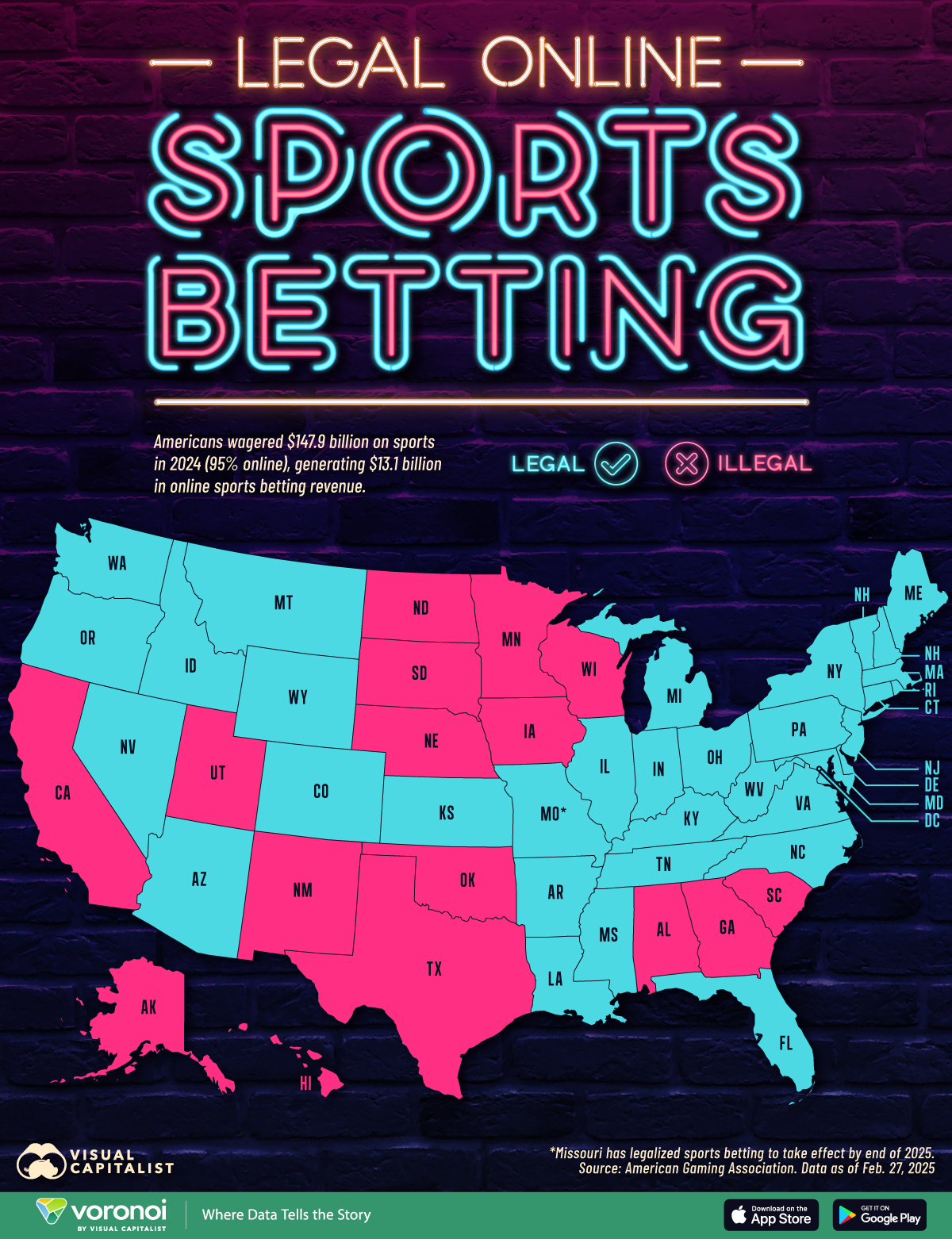

- 39 Jurisdictions (38 states plus D.C. and Puerto Rico) have legalized sports betting in some capacity.

- 31 States offer statewide mobile and online wagering, allowing users to place bets from their smartphones anywhere within state lines.

- Recent Wins: Missouri became the latest major market to go live on December 1, 2025, after a successful voter initiative in late 2024.

However, the “Big Three”, California, Texas, and Georgia remain the holdouts. While Texas saw significant legislative movement in 2023, the state’s biennial legislature means 2025 and 2026 are the critical years for potential breakthroughs. California, on the other hand, remains complex due to the competing interests of tribal gaming operators and commercial sportsbooks.

Regulatory Oversight and Licensing

The decentralized nature of us betting means each state serves as its own regulatory island. For instance, New York maintains a high-tax model (51% on gross gaming revenue), while states like Nevada and Iowa offer much lower rates (6.75%). This disparity influences how operators market to users and the types of promotions available to bettors in those regions.

For more detailed legislative tracking, resources like the Legal Sports Report provide real-time updates on state-by-state bill progress.

Market Giants: Who Owns the Handle?

The us betting market is currently dominated by a handful of titans that have successfully leveraged their daily fantasy sports (DFS) roots or international experience into massive market shares.

The “Big Two”

- FanDuel: Consistently holding the top spot in terms of Gross Gaming Revenue (GGR), FanDuel has excelled through a superior user interface and its popular “Same Game Parlay” features.

- DraftKings: Following closely, DraftKings remains a powerhouse in customer acquisition, often leading the market in total “handle” (the total amount of money wagered).

The Challengers

Beyond the leaders, the landscape is becoming increasingly competitive:

- BetMGM: A joint venture between MGM Resorts and Entain, leveraging its deep ties to physical casino loyalty programs.

- Caesars Sportsbook: Known for its aggressive rewards program that links digital betting to stays at its iconic properties.

- Fanatics Sportsbook: A newer entrant that is disrupting the market by integrating betting directly with its massive sports merchandise database.

- ESPN BET: The result of a major partnership between PENN Entertainment and the sports media giant, aiming to capture the casual fan’s attention.

Market Share Dynamics

According to 2025 data, FanDuel and DraftKings combined control roughly 70–80% of the regulated mobile market in most states. This duopoly has forced smaller operators to find niche markets or innovative technology to stay relevant.

The Economics of US Betting: Tax Windfalls and Revenue Records

The financial impact of us betting on state coffers has been substantial. In 2024, the commercial gaming sector generated a record $72 billion in revenue, with sports betting contributing a significant portion of that growth.

Revenue Projections for 2025/2026

Forecasters project that Americans will legally wager between $160 billion and $170 billion in 2025. This surge is driven by:

- Improved Hold Percentages: Operators are becoming more efficient, with average “hold” (the percentage of wagers the bookie keeps) rising from 8% to nearly 10% in some jurisdictions.

- New State Launches: The full-year impact of markets like North Carolina and the addition of Missouri.

- The Rise of iGaming: While sports betting gets the headlines, online casino gaming (iGaming) generates significantly more revenue per user in the few states where it is legal (such as PA, NJ, and MI).

| State | 2024 Tax Revenue (Estimated) | Top Operator |

| New York | $912 Million | FanDuel |

| Illinois | $240 Million | DraftKings |

| Pennsylvania | $187 Million | FanDuel |

| Ohio | $143 Million | DraftKings |

The tax revenue generated is often earmarked for specific public works. For example, in many states, us betting taxes fund education, problem gambling programs, and infrastructure projects. To see a full breakdown of how these funds are distributed, you can visit the American Gaming Association (AGA).

Popular Betting Markets: What Are Americans Wagering On?

While horse racing was once the king of us betting, the focus has shifted entirely to major professional and collegiate sports.

1. The NFL: The Undisputed King

Football is the engine of the American betting industry. Over 60% of all bettors place wagers on the NFL. The Super Bowl alone accounts for billions of dollars in handle, becoming an unofficial national holiday for the betting public.

2. The Rise of the NBA and MLB

The NBA attracts about 58% of active bettors, thanks to the high volume of games and the suitability of basketball for “live betting.” MLB follows closely, benefitting from a massive 162-game schedule that provides a steady stream of data for statistical bettors.

3. Emerging Markets: eSports and Micro-Betting

As we look toward 2026, two areas are growing faster than any others:

- eSports: Approximately 23% of bettors now engage with competitive gaming. The eSports betting market is projected to hit $1.1 billion by 2028.

- Micro-Betting: This involves wagering on minute events within a game, such as “will the next pitch be a strike?” or “will this drive result in a touchdown?” This “instant gratification” model is becoming a staple of the mobile us betting experience.

The Engine of “Next-Play” Wagering: Technical Aspects of Micro-Betting Algorithms

While a standard moneyline bet requires a simple calculation of win probability, us betting on a “micro” scale such as the result of the next pitch in a baseball game, demands a technological stack that operates in milliseconds. To the end-user, it feels like magic; behind the scenes, it is a feat of high-frequency data engineering and predictive modeling.

1. The Zero-Latency Tech Stack

For micro-betting to work, the “betting window” must close before the play occurs. This creates a race against time where every millisecond counts.

- Low-Latency Data Ingestion: Modern sportsbooks use event-driven architectures, often powered by Apache Kafka or Apache Flink, to ingest raw data from stadiums. Sensors in balls, player jerseys (RFID), and high-speed computer vision cameras capture events the moment they happen.

- Edge Computing: To reduce the distance data must travel, many operators are moving their odds-calculation engines to the “edge”—servers located physically closer to the end-user or the sporting venue. This minimizes the “round-trip” time between a play occurring and the odds being updated on a mobile device.

2. Machine Learning and Price Discovery

The algorithms responsible for us betting prices must account for thousands of variables simultaneously. Unlike pre-game odds, which are shaped by market volume, micro-betting odds are driven by predictive AI.

- Gradient Boosting & Neural Networks: These models analyze a pitcher’s fatigue, the batter’s historical performance against specific pitch types, and even wind speed to determine the probability of a strike versus a ball.

- Automated Risk Management: Because micro-markets open and close so quickly, human “traders” cannot manually adjust lines. Instead, AI-powered risk systems monitor betting patterns in real-time to detect “sharp” activity or potential data leaks, automatically adjusting the vig (the house edge) to protect the sportsbook’s margin.

3. The “Watch-to-Wager” Sync Challenge

One of the biggest technical hurdles in us betting is the “broadcast delay.” Most live TV streams are 10–30 seconds behind the actual action.

- The Problem: If a bettor sees a touchdown on TV, the “next play” market on their app might already be closed because the sportsbook’s data feed is faster than the video.

- The Solution: 2026 is seeing the widespread adoption of Ultra-Low Latency (ULL) streaming, which uses protocols like WebRTC to bring video delay down to under one second, synchronizing the visual experience with the betting market.

Microbetting and Latency Challenges This video features industry experts discussing the critical need for zero-latency technology to support the rapid growth of micro-betting in the sports world.

Microbetting and Other Factors Driving Ultra-Low-Latency Streaming – YouTube

Technology and Innovation: The 2026 Outlook

The technology behind us betting platforms is evolving from simple transaction engines into highly personalized entertainment hubs.

AI and Personalization

Artificial Intelligence is no longer a buzzword; it’s a baseline. In 2026, we expect to see:

- Dynamic Odds: AI models that adjust pricing in real-time based on millions of data points, including player biometrics and weather conditions.

- Personalized Feeds: Apps that learn your betting habits and highlight the games and props you are most likely to be interested in.

- Predictive Analytics: Tools that help bettors analyze trends, though these are often “cat-and-mouse” games between sharp bettors and bookmakers.

Blockchain and Cryptocurrency

While most regulated us betting sites still rely on traditional banking, Wyoming’s adoption of blockchain for sports betting transactions has set a precedent. We are seeing a move toward faster, more transparent payout systems powered by ledger technology, reducing the 2-3 day wait times for withdrawals to mere minutes.

Social Betting and Gamification

The next generation of bettors views wagering as a social activity. Features like “Bet With Streamers” or peer-to-peer (P2P) betting pools, where you bet against friends rather than the “house”—are gaining traction. This blurring of lines between social media and gambling is a key trend to watch in the coming year.

The Data Giants: Sportradar vs. Genius Sports (2025/2026)

In the high-stakes world of us betting, data is the primary currency. Two companies, Sportradar and Genius Sports, effectively control the flow of “official” data from the leagues to the sportsbooks. While they provide similar services, their strategic focuses and market positioning have diverged significantly as we enter 2026.

Comparison of Key Providers

| Feature | Sportradar (SRAD) | Genius Sports (GENI) |

| Market Cap (Dec 2025) | ~$6.9 Billion | ~$2.6 Billion |

| Primary Exclusive Rights | NBA, NHL, ATP Tour, MLB (Partial) | NFL, English Premier League (EPL) |

| Strategic Focus | “Monolithic” Tech Stack (Data + AV + Trading) | High-Margin Pure Data & Media Technology |

| Micro-Betting Strength | Deep Tennis markets & AI-simulated results | NFL “GeniusIQ” high-fidelity tracking |

| Revenue Growth (2025) | ~15% YoY | ~28% YoY |

Key Differences in Technology and Approach

Sportradar: The “End-to-End” Powerhouse

Sportradar has positioned itself as a full-service technology partner. Beyond just providing scores, they offer Managed Trading Services (MTS), where they actually handle the risk management and odds-setting for smaller sportsbooks. Their 2025 acquisition of IMG Arena solidified their dominance in tennis and golf, giving them control over roughly 70% of the rights across the top three global betting sports.

Genius Sports: The “Official Data” Specialist

Genius Sports has leaned heavily into its exclusive partnership with the NFL. If a us betting app wants to market itself using “Official NFL Data,” they must go through Genius. In 2025, Genius saw massive growth in its media segment, using data to power personalized advertisements for bettors, proving that data isn’t just for setting odds, it’s for finding customers.

The Challenger: LSports and “The Long Tail”

While the big two focus on major leagues, providers like LSports have gained ground by offering “The Long Tail” of sports. They focus on sub-second latency for niche sports (like table tennis or regional soccer leagues) that provide 24/7 betting content for operators when major US leagues are out of season.

Why “Official” Data Matters

In many US jurisdictions, state regulators require sportsbooks to use “official league data” to settle certain types of wagers, particularly fast-moving in-play bets. This regulatory requirement gives Sportradar and Genius Sports immense leverage, as they are often the only legal source for this information.

Financial and Regulatory Friction: Tax Implications for Data Providers

While much of the public discourse surrounding us betting focuses on the taxes paid by operators (sportsbooks), the data providers themselves face a complex and evolving fiscal landscape. As we look toward the 2026 fiscal year, three key tax areas are defining how companies like Sportradar and Genius Sports operate.

A. The “Official Data” Sales Tax Debate

In several states, “official league data” is categorized as a digital service or a software-as-a-service (SaaS) product. This makes it subject to state sales and use taxes. However, because the data is “consumed” by the sportsbook’s servers (which may be in one state) but “utilized” by bettors (who are in another), determining the tax nexus is a constant legal battle.

B. Federal Excise Taxes and the “Cost of Doing Business”

Under Internal Revenue Code Section 4401, a federal excise tax of 0.25% is placed on the total “handle” of legal wagers. While this is paid by the operator, it creates downward pressure on the fees data providers can charge. As operators look to protect their margins, data providers are increasingly forced to move toward revenue-sharing modelsrather than flat licensing fees, which changes their corporate tax classification from “service provider” to “business partner.”

C. International Tax Nexus (Pillar Two)

Since many major us betting data providers are headquartered in Europe (e.g., Sportradar in Switzerland, Genius Sports in the UK), they are subject to the OECD’s “Pillar Two” global minimum tax of 15%. This has led to a restructuring of how these companies book revenue from US-based sportsbooks to avoid double taxation.

Developer’s Guide: Integrating Betting APIs for 2026

For developers looking to build custom dashboards, odds aggregators, or automated trading bots, the integration of us betting data requires a focus on scalability and sub-second latency.

Step 1: Selecting the Protocol (WebSocket vs. REST)

- REST API: Best for “static” data such as league schedules, player rosters, and historical results.

- WebSockets: Essential for us betting odds. A WebSocket connection allows the provider to “push” updates to your dashboard the millisecond a line moves, rather than your server constantly “polling” for updates.

Step 2: Sample Integration Architecture (Node.js/Python)

A modern betting dashboard should follow a microservices architecture:

- The Ingestor: A dedicated service that maintains a heartbeat with the provider’s WebSocket (e.g.,

wss://api.sportradar.com/nfl/stream). - The Normalizer: A layer that converts different provider formats into a single internal schema.

- The Cache (Redis): Stores the “Current State” of all active lines so your frontend doesn’t have to query a database for every frame update.

Step 3: Handling the “Kill Switch”

In us betting, data providers send a market_status flag. If this flag changes from open to suspended, your dashboard must instantly disable betting buttons. This usually happens during a video review or a critical injury.

Responsible Gambling: The Industry’s Most Important Challenge

As us betting becomes more accessible, the focus on responsible gambling (RG) has never been higher. The industry recognizes that sustainable growth depends on player protection.

Enhanced RG Tools

Most major apps now include built-in tools that allow users to:

- Set Deposit Limits: Limiting how much money can be added to an account daily, weekly, or monthly.

- Time-Outs: Voluntarily locking yourself out of an app for a set period.

- Self-Exclusion: A permanent or long-term ban across all regulated platforms in a state.

Awareness and Education

In 2025, over 72% of Americans reported seeing responsible gaming messaging, a significant increase from previous years. Organizations like the National Council on Problem Gambling (NCPG) work alongside operators to provide 24/7 support through hotlines like 1-800-GAMBLER.

“The goal of the industry is to ensure that gambling remains a form of entertainment, not a source of financial or emotional distress.” — David Forman, VP of Research, AGA.

Future Trends: What’s Next for US Betting?

Looking ahead to 2026, several key shifts are expected to redefine the industry:

- Convergence of Media and Betting: Expect to see more “watch and bet” integrations where live streams are embedded directly into the betting interface.

- iGaming Expansion: As sports betting markets mature, states will look to online slots and table games for the next wave of tax revenue.

- Federal Oversight? While betting is currently state-regulated, there are ongoing discussions in D.C. regarding federal standards for advertising and consumer protection.

- Women’s Sports: A massive surge in betting on the WNBA and women’s soccer is expected to continue, driven by rising viewership and star power.

Conclusion: The New Era of American Entertainment

The world of us betting has moved past its “gold rush” phase and into a period of sophisticated maturity. With 39 jurisdictions already on board and the remaining states feeling the pressure of lost tax revenue, the trajectory is clear. For the consumer, this means better apps, more competitive odds, and safer platforms. For the states, it means a reliable new revenue stream.

As technology continues to merge with live sports, the boundary between being a fan and being a bettor will continue to thin. Whether you are a casual fan putting $5 on the Super Bowl or a data-driven enthusiast, the infrastructure of us betting is now a permanent fixture of the American sports experience.

Internal Resources & Further Reading

- Check our State-by-State Betting Guide

- How to Read Betting Odds: A Beginner’s Tutorial

- Top 10 Sportsbooks Reviewed for 2026

External Resources

- American Gaming Association – State of the Industry

- National Council on Problem Gambling

- Tax Foundation – Sports Betting Taxes by State

Don’t Just Watch the Game, Own the Outcome

The difference between a “hunch” and a “hedge” is data. While the average bettor is reacting to the broadcast, our subscribers are already ahead of the line movement. We combine high-frequency data feeds with proprietary machine learning to deliver the most accurate us betting predictions directly to your inbox.

Why the Pros Subscribe:

- Sub-Second Advantage: Our algorithms process play-by-play data 3–5 seconds faster than standard TV streams.

- Verified Track Record: Transparent reporting on every “Edge” we identify, with a historical win rate of 54.2% on NFL player props.

- Micro-Market Alerts: Real-time notifications for high-value windows in “Next Play” and “Next Drive” markets.

“This isn’t gambling; it’s probability management. The data-driven insights here changed how I approach my entire bankroll.” – Verified Subscriber, 2025

Ready for the Edge?

Join 25,000+ sharp bettors who receive our “Market-Mover” alerts every morning. 2026 Season Passes are now open.

GET MY PREDICTIONS NOW No credit card required for the 7-day free trial. Cancel anytime.

Comments 1